- Peter Lohmann's Newsletter

- Posts

- Peter Lohmann's Newsletter - Issue #165

Peter Lohmann's Newsletter - Issue #165

You Confirmed It: Owner Lead Flow is Down YoY

Responses to my newsletter poll from last Friday:

This backs up the data from RentScale that I shared last week.

I was extremely curious about what could be driving this drop in lead flow, so I reached out to Jeremy Pound, CEO of RentScale, to discuss the results with him.

What followed was a fascinating deep dive into what’s happening in our world right now.

Highly recommend giving this a watch if you own or operate a 3rd party management company, as it’s directly relevant to what’s been going on in our industry and where we think things are headed. Thanks to Jeremy for hosting the discussion and being game to stream it live on short notice.

THIS ISSUE PRESENTED BY APARTMENTS.COM

Earlier this year, we ran a simple experiment: we stopped paying for Zillow’s premium listing product… and nothing happened.

It confirmed what I’ve been saying for a while now: Zillow is trying to own the renter demand side of property management, and charging for a service that (in my experience) doesn’t move the needle.

They control where renters start their search, and once you control that, you control everything that follows. Paying for their premium product doesn’t make us stronger - it just tightens the leash.

So we redirected that same budget to Feed Pro with Apartments.com, and that’s where things actually changed.

Since May, Apartments.com’s share of our total renter leads has grown by 44%. No gimmicks, no overhaul - just a smarter use of the same spend.

Apartments.com Feed Pro has helped us reach more renters while keeping control of how we operate, and I’m excited to see where it goes from here.

If you have any questions, you can email my contact (Joseph Beebe) directly at [email protected] (or click below to schedule a demo).

— Peter

Is the Bank Behind Your Trust Account Actually Protecting You?

If you manage rental properties, your trust account setup is either:

A) totally fine

OR

B) a ticking time bomb that could lock up your operating funds overnight.

The worst part? It’s almost impossible to tell which one you have.

In this week’s podcast, I sat down with Allison DiSarro, SVP at Enterprise Bank & Trust, who specializes in banking for property management companies. We dug into why most banks don’t actually understand trust accounts, how earnings credits work (and why they often matter more than interest rates), what happens when a single garnishment or lien hits your trust account (it’s not good), and the specific questions to ask your bank to stay out of compliance trouble.

The truth is… nobody teaches us this stuff. Not your CE, not the state, not your CPA. Meanwhile, improper banking is one of the top reasons PMs get dinged in audits, resulting in fines, education requirements, suspended licenses and worse.

If you’ve ever wondered whether your trust account is actually set up correctly, this episode might save you a ton of pain down the road.

(You can also listen on Apple Podcasts or Spotify)

New Property Management Companies For Sale This Week

Buying or growing a property management company? Enterprise Bank & Trust* (sound familiar?) helps operators offset fees, manage trust accounts, and get financing without the runaround. Check out their PM lending solutions if you’re going to buy one of these companies:

Here’s a PM company for sale in western Wisconsin (asking $3.2 million, 2.7x revenue)

Here’s a PM company for sale in Utah (asking $700k, 0.3x revenue)

Here’s a PM company for sale in Minnesota (asking $759k, 1.5x revenue)

Here’s a PMC for sale in Kissimmee, FL (asking $260k, 18 units, 0.6x revenue)

This PM company in Portland, OR is still for sale (asking $750k, 0.4x revenue)

*Sponsored.

Industry News & Events

Wondering why smoke alarm prices have gone up so much? Phil Owen has a great write-up about this and why it’s actually great news for PMs.

Showmojo just announced the upcoming Q3 Leasing Data Talk. Register here to catch it live or get the recording (joined by PlanOmatic CEO Kori Covrigaru). They are the OGs of leasing data and still do an amazing job.

NARPM has really ramped up their legislative efforts in DC. Please help them help you by submitting your lead paint story to the EPA. Every property manager should belong to NARPM. Join here (just $22.50/mo for new members).

Blakely Hughes announces the sale of his PM company Nest Finders to Associa’s RHOME. Congratulations to Blakely & all involved!

Closing Thought

Since 2019, real personal spending has only increased for the top fifth of earners — that’s one reason why Americans don’t think their finances are improving.

My @Morning_Joe Chart

— Steven Rattner (@SteveRattner)

11:54 AM • Nov 6, 2025

A few quick things before you go…

Last week’s issue went to 20,117 readers (77.31% opened, 4.06% clicked)

The most popular link was Jay Parson’s LinkedIn post about SFH owner distribution (166 clicks)

Interested in sponsoring this newsletter? Sold out. Will open Q1 soon.

Did someone forward you this email? Subscribe here.

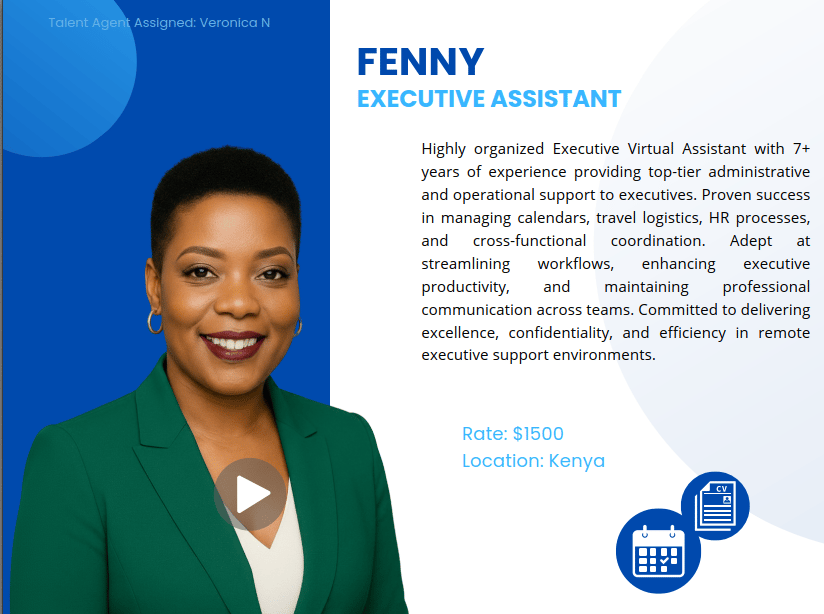

Personal Assistant Available Now

If you’ve been looking to hire a personal or executive assistant, please allow me to introduce Fenny.

She’s gone through extensive training for this role at a top-tier recruiting agency and is already supporting an American CEO, but is now looking for a direct role (instead of working through Athena like she is now - they bill her out at $3000/mo and she only takes home 30% of that).

Fenny will work directly for you. You’ll pay a one-time fee only if you decide to hire, AFTER you’ve interviewed her.

She’s asking for $8.65/hr ($1500/month). Full-time employment.

Review her resume.

Watch her video introduction.

If you’re ready, book an interview.

Software I use to run my 700-door property management company:

|

|

Note: These are affiliate links.

The content of this newsletter is for informational purposes only and does not constitute professional advice. I may have consulting agreements with, or financial interests in, companies mentioned in this newsletter. Additionally, some of the links included in this newsletter are affiliate links, meaning I may earn a commission if you make a purchase through these links. Always perform your own due diligence before making any financial or business decisions.