- Peter Lohmann's Newsletter

- Posts

- Peter Lohmann's Newsletter - Issue #164

Peter Lohmann's Newsletter - Issue #164

Are Owner Leads are DOWN nationwide?

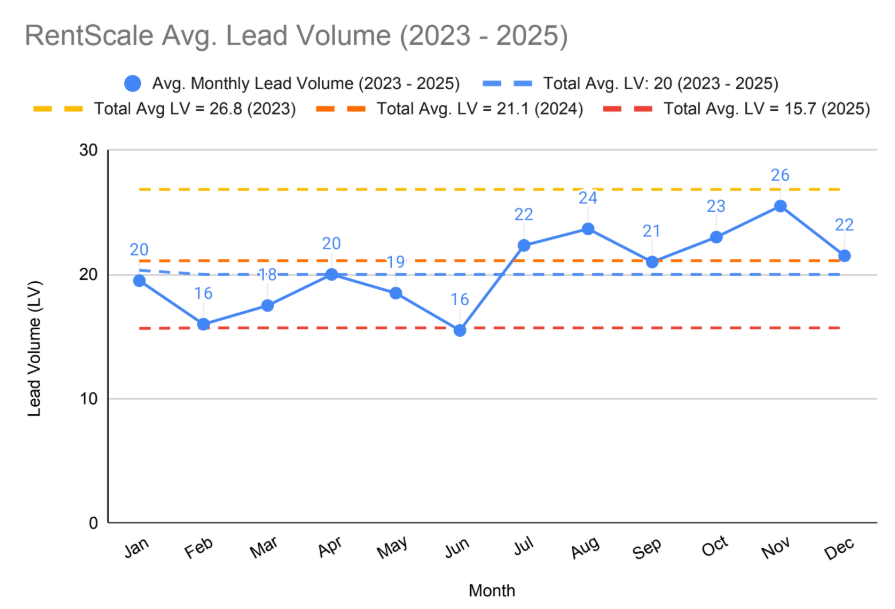

I love the data that RentScale pulls together each month. They operate a property management salesperson (BDM) coaching business, and compile data about owner lead flow, releasing it as part of a monthly scoreboard. It provides us with a great snapshot of how property management companies are doing nationwide.

I pulled together a few years of their data to see how lead flow looks, check it out:

Owner Lead Flow Data via RentScale, 2023-2025

Lead flow is dropping year-over-year. In 2024, leads were down 21% compared to the prior year. And now 2025 is shaping up to drop a further 26% on the already-low 2024 number. Yikes!

It’s also interesting seasonal the lead flow is. There is a clear pop in the 2nd half of the year compared to the first half.

I wish we had more data here… like from some type of CRM software that handles property management owner leads…🤔

Let’s see if my readers are experiencing the same… please vote:

Is Owner lead flow down for you compared to last year? |

THIS ISSUE IS PRESENTED BY UTILITY PROFIT

Utility Profit will pay you $500 to try their tool

If you’ve been following me, you’ve probably seen Utility Profit mentioned here before. They make some bold claims that their free tool tells you when tenants set up their utilities, and even pays you when they do.

If you’re like me, you might be skeptical - sometimes vendors overpromise and underdeliver. But Utility Profit is the real deal.

And now, just for my audience, they’re willing to put their money where their mouth is…

If you book a demo by Nov. 14, they’ll pay you $500 the first time a tenant uses the tool to set up their utilities.

No contract. No gimmicks. No strings attached. Just $500 to try something that actually works.

If you’ve ever thought about giving it a shot, now’s the time.

Thanks,

Peter

Can PropTech finally fix multifamily’s oldest problems?

If you’ve ever wondered why tenant screening still feels broken, how rental fraud keeps rising, or why security deposits still exist (and why no one’s managed to fix any of this yet), this episode will get your wheels turning.

I sat down with Janine Steiner Jovanovic, CEO of LeaseLock, to talk about how her company is replacing deposits with true lease insurance, protecting owners and improving affordability for renters.

We dig into how AI and risk analytics are reshaping the multifamily world, what’s really driving fraud and bad debt, and why some PropTech startups are quietly disappearing in this tighter funding environment. Janine also shares what it means to build “renter-first” products in an industry that’s often profit-first (it’s harder than it sounds).

If you’re curious where multifamily tech is headed (or just want to understand risk management from someone who’s been in the trenches), definitely check this one out:

(You can also listen on Apple Podcasts or Spotify)

New Property Management Companies For Sale This Week

Here’s a PM company for sale in Orange County, CA (asking $1.9M on 780k in revenue)

Here’s a PM company for sale in Palm Beach County, FL (asking $1.2M on 1.5M in revenue, 278 doors)

Here’s a PM company for sale in Central Washington (asking $545k)

Here’s a PM company for sale in San Francisco, CA (asking $725k on 1.16M in revenue)

This section is sponsored by Rentvine. Rentvine is the all-in-one platform built for property managers who want clean accounting, connected workflows, and zero feature paywalls. You deserve better - we’re here to make that happen. Contact for fall promos.

Industry News & Events

RentEngine’s Q3 Leasing Report was just released. Required reading if you own or manage residential rentals. Deserves its own breakdown article; maybe Todd O will do another one.

Renter’s Warehouse CEO Kevin Ortner has stepped down. Last year we found out the company was sold to Japanese firm GA Technologies for $8M, and I’ve been dying for any type of update ever since. GA Technologies is an amazing company in its own right and deserves a full writeup in this newsletter.

Jay Parsons has a great graphic here showing the distribution of single-family home ownership among homeowners, small investors, and institutional landlords.

Douglas Elliman sold their property management division to PMG, an Associa subsidiary (Associa also owns Rhome) for $85M. That business did $20M in revenue in the first half of 2025, implying a ~2x multiple on revenue.

SFR rent growth drops to the lowest level in 15 years, per CNBC.

Buildium released their annual property management industry report. They’re calling it “2026”, but my calendar says the year is still 2025… guys?

Closing Thought

Many do not realize a key differentiator of the U.S. until they travel extensively beyond the usual destinations.

Here, even those with a relatively basic skill level, enjoy an incredible quality of life that would not be transferable in most countries.

It’s just that here in

— Bethany | Commercial Real Estate (@bethanyjbabcock)

11:59 AM • Oct 12, 2025

A few quick things before you go…

Last week’s issue went to 20,190 readers (69.9% opened, 3.75% clicked)

The most popular link was Renter Application Fraud from WSJ (83 clicks)

Interested in sponsoring this newsletter? Sold out. Will open Q1 soon.

Did someone forward you this email? Subscribe here.

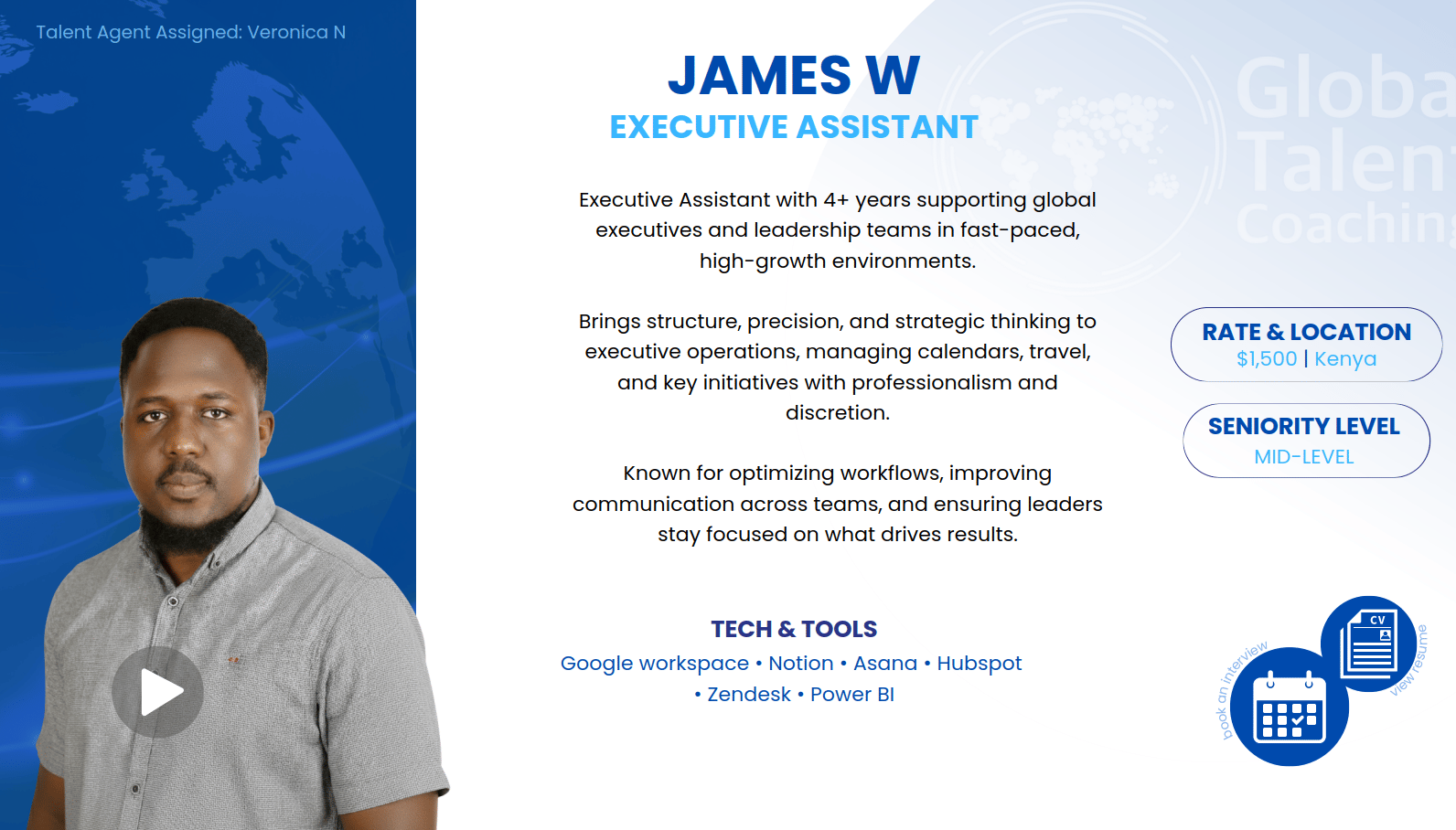

Executive Assistant Available Now

Two years ago I hired my first executive assistant.

It was one of the best decisions I’ve ever made for myself.

My assistant Monica helps me with an unbelievable amount of business and personal tasks each week. It would take up the entire newsletter if I listed out everything she does for me now. The leverage this has unlocked is a critical part of what allows me to juggle multiple businesses while raising a family and keeping my working hours under 40/week.

If you’ve been on the fence about this, I encourage you to check out James. He’s an Athena-trained EA currently working as executive assistant to the CEO of a US-based robotics company. James lives in Kenya and ready for a new role.

Janes will work directly for you. You’ll pay a one-time fee only if you decide to hire, AFTER you’ve interviewed him.

Next steps:

Review his resume.

Watch his video introduction.

If you’re ready, book an interview with James.

Software I use to run my 700-door property management company:

|

|

Note: These are affiliate links.

The content of this newsletter is for informational purposes only and does not constitute professional advice. I may have consulting agreements with, or financial interests in, companies mentioned in this newsletter. Additionally, some of the links included in this newsletter are affiliate links, meaning I may earn a commission if you make a purchase through these links. Always perform your own due diligence before making any financial or business decisions.