- Peter Lohmann's Newsletter

- Posts

- Peter Lohmann's Newsletter - Issue #173

Peter Lohmann's Newsletter - Issue #173

Interview with a 20k-door CEO. Palm Beach PM company for sale for $1.2M.

Are You Hitting a Growth Wall?

Years ago I became kind of obsessed with the idea of hitting a growth ceiling at my property management company. A growth ceiling is when you are churning out the same number of units you’re adding each month (so your net unit growth is zero or close to it). This happens naturally as you scale up, because churn as as % of units under management tends to stay flat unless you do something about it, whereas your lead flow each month is independent of your company size (and therefore does not scale up as your grow, absent active effort).

So if you’re adding 10 doors a month and churning 25% annually, you will max out at 400 doors and stay there permanently unless one of those 2 numbers changes. I first wrote about this on the blog back in 2022.

What’s more, as you approach your ceiling, the growth slows dramatically. You really never want to be larger than 75% of your theoretical maximum; some people call this the Growth Wall.

This week I created a way to visualize it, which I think really helps drive the point home and makes it easy to experiment (try adjusting the numbers to see how best to increase your growth ceiling/wall).

As you play with this, take note of a few important things:

The red line on the graph represents your growth wall (75% of your maximum size). Note it may be “behind you”, meaning you’re already at your wall.

Small changes in unit churn can have a HUGE effect on your growth wall/ceiling.

Unit churn is separate from client churn, and this effect is magnified if you’re working with lots of multi-unit owners. Client churn is the best metric to evaluate your company’s operational & customer service, whereas unit churn is best for forecasting growth.

Unit lifetime value is calculated by taking your annual revenue per unit and dividing your churn rate into it.

I hope this helps as you start (or wrap up) 2026 planning for your management company!

THIS ISSUE IS PRESENTED BY UTILITY PROFIT

Mandatory Fees Are Moving Into the Rent Price

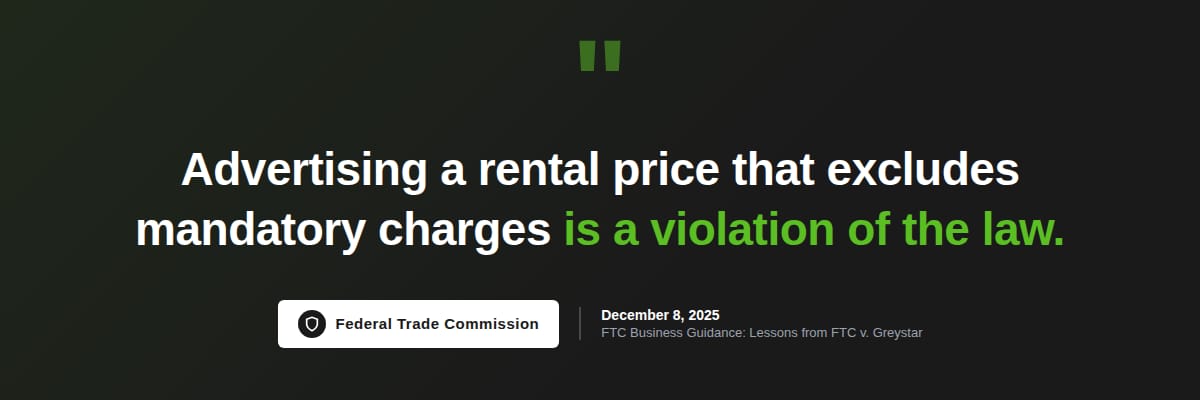

In December, the FTC published guidance for property managers:

And states are already moving. Colorado, Massachusetts, and Connecticut have passed “all-in pricing” laws for rental properties, and the FTC is pushing for a federal rule.

If your pricing includes mandatory monthly fees outside of rent, this is relevant to you.

Utility Profit put together a breakdown that covers:

The actual federal and state requirements (with links to source docs)

A calculator showing how your listings will be affected

Revenue options that don't require tenant-facing fees

Worth 5 minutes if mandatory fees are part of your model.

17 Acquisitions in 6 Months?!

Matthew Whitaker, CEO of Evernest, is back on the pod! And let’s just say, a lot has changed since his first appearance back in June of 2022.

Evernest is now at 20,000+ doors across 50+ markets. And get this: they’ve acquired 17 PM companies in the last six months alone.

We talk about how their org chart has evolved (they ditched pods…), what they’ve learned from onboarding all those acquisitions, and why the “property manager” job title is making a comeback. Check it out:

(Check out other episodes on Apple Podcasts or Spotify)

Property Management Companies For Sale This Week

This PM company is for sale in Sacramento and Bay Area CA (asking $225k, 36 doors)

An HOA/Condo Management firm is for sale in Hillsborough County, FL (asking $565k, 42 associations)

This PM company in Palm Beach County, FL is still available (asking $1.2M, 278 doors)

Here’s another PM company for sale in Fontana, CA (asking $350k)

This PM company in North Dartmouth, MA is for sale (asking $225k)

Tired of the “did anyone call that guy back” at 6PM Friday? Super solves it. This AI receptionist for PMs handles calls 24/7, answers FAQs, routes calls, shares listings, escalates emergencies, creates work orders, and syncs with your tech. Check it out.

Industry News & Events

Trump says he wants to ban institutional ownership of single-family homes.

PMAssist and Crane announced a partnership that will deliver PMAssist paid and free content each week directly inside the Crane community, including email newsletters that are only available to paid PMAssist subscribers.

Excited to be speaking at the PM Systems Conference next week. Say hi if you see me!

Propmodo is reporting on the AppFolio/Beagle dispute.

Season 6 of my property management podcast premiered yesterday, with an all-new format (every other week year-round), and one of our first-ever repeat guests (Matthew Whitaker, CEO of Evernest). Subscribe in your favorite podcast player or on Youtube.

Closing Thought

A few quick things before you go…

Last week’s issue went to 19,460 readers (78.5% opened, 2.8% clicked)

The most popular link was the X post from Barrett Linburg (151 clicks)

Interested in sponsoring this newsletter? Q1 slots are full for the Friday Newsletter, but we just launched a Tuesday Edition with more availability. Message me for details.

Property managers: Your professional trade association is NARPM. You need to join if you’re not already a member.

Did someone forward you this email? Subscribe here.

PeterBot

Chat with PeterBot, my AI clone (try the audio). It’s trained on almost everything I’ve ever written or said, and can help you talk through your most challenging PM questions and problems. Give it a try and let me know what you think!

Over 100 property managers have used this in the last couple months(!) Many are returning weekly to ask me their hardest property management questions.

Software I’m using to scale my 700+ door property management company:

|

|

Note: These are affiliate links, but I’ve been recommending all these companies long before any financial arrangements came into place.

The content of this newsletter is for informational purposes only and does not constitute professional advice. I may have consulting agreements with, or financial interests in, companies mentioned in this newsletter. Additionally, some of the links included in this newsletter are affiliate links, meaning I may earn a commission if you make a purchase through these links. Always perform your own due diligence before making any financial or business decisions.