- Peter Lohmann's Newsletter

- Posts

- Peter Lohmann's Newsletter - Issue #150

Peter Lohmann's Newsletter - Issue #150

Co-owner’s $1M theft wrecks property management firm. 4 new PM companies for sale.

Exit Your PM Business By Selling?

Yesterday, I joined this lively ProfitCoach panel to discuss positioning your PM business to achieve the best possible sale price. This is highly relevant for anyone who owns a property management company (even if you don’t have any current plans to sell—which I do not), because as a byproduct, you will naturally increase profits and reduce the business’s reliance on you, the founder.

Great discussion all around with top dogs at Evernest (Spencer Sutton) and Rhome (Kit Garren).

Catch the replay here, and buy the 2025 Property Management M&A Report right here. Use discount code PROFIT25 for 25% off, ends July 31st.

Side note: if you own a PM company in Ohio and are ready to hang up your hat, reach out.

THIS ISSUE PRESENTED BY BOOM

Modern rental financial services

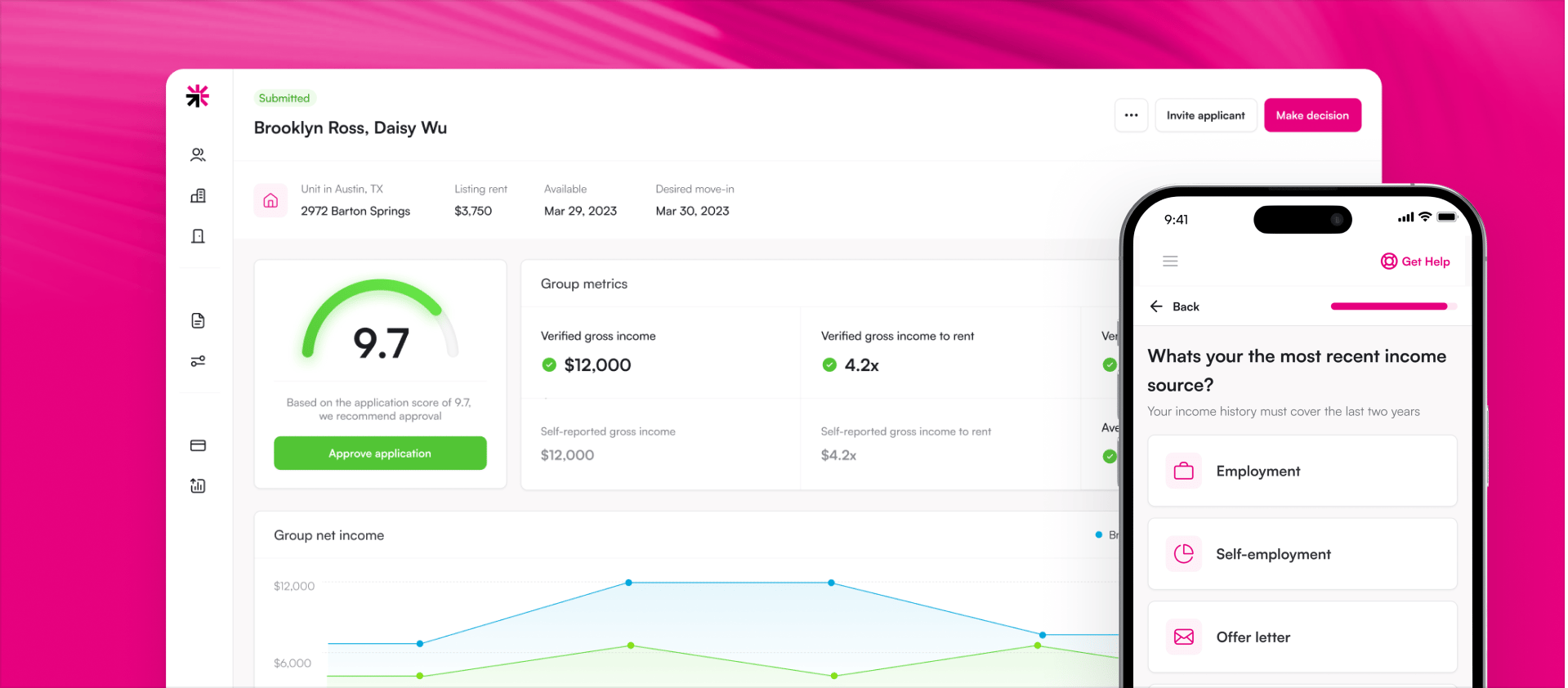

BoomScreen is a flexible tenant screening tool that helps you spot fraud faster, lease more efficiently, and place better renters.

Configurable templates for screening criteria, services, application fees, and more

24/7 applicant support - average response times under two minutes

Layered fraud detection, including identity and document verification

Best-in-class data sources for income, criminal, eviction, animal screening, and more

“The fact that I’m not hearing complaints from applicants? That means something is working very, very well behind the scenes.”

- Natalie Jones, Marketing Manager at RENU Property Management

Integrates with:

Please Take My 2025 Reader Survey

I’ve never done a reader survey before, so we’re way overdue. I would be eternally grateful if you could click this link and take a VERY SHORT 4-question survey. It will take you less than 10 seconds.

I will choose a survey respondent at random to win* a $100 Amazon gift card!

*Survey due August 6th, 2025. One entry per person. U.S. residents only. No purchase necessary. Odds of winning depend entirely on how many people actually read this fine print. So… looking good for you!

New Property Management Companies For Sale This Week

I’ve purchased 2 property management companies on the journey to grow RL. Next time, I’ll be using Live Oak Bank’s Property Management Lending Team to finance the deal. This will give me a huge advantage, since I won’t be reliant on the seller to help me finance the acquisition!

Here is a property management company for sale in El Cajon, CA

(asking $600k)Here is a property management company for sale in Ontario, OR

(asking $452k)Here is a property management company for sale in Florida

(asking $1.4M, 350 units)Here is an association management company for sale in Collier County, FL

(asking $130k)

Industry News & Events

I have brand new podcast & newsletter sponsor packages available, with a few Q3 openings. Reach out for more info.

The UK is poised to force landlords to accept pets in rentals (wild), and there’s some confusing fallout.

Co-owner’s $1M theft wrecked property management firm, partner says - BusinessDen

I’m not sure what “instant payments” refers to exactly, but this article seems to feel that property managers and tenants are using them more and more.

Northpoint, #7 on the list of largest 3rd party property management companies, has selected AppFolio as their property accounting software.

Doorvest has acquired Wreno.

Closing Thought

This is exactly why I left X/Twitter at the end of last year. The only time I log in is to find a post for this portion of the newsletter, and I quickly log back out:

The problem with the current X algo:

If you write interesting, high-signal posts targeted to small niches, these get ~no distro, meaning even your followers who have explicitly opted in to get these posts don't see them, and you get no Elonbux.

The algo "wants" posts that are

— Moses Kagan (@moseskagan)

1:59 PM • Jul 24, 2025

~ ~ ~

P.S. Did someone forward you this email?

Stats from last week’s issue:

Valid Recipients: 16,203

Open Rate: 70.3%

Clickthrough Rate: 3.7%

Most Popular Link (117 clicks): The 4 Disciplines of Execution by Chris McChesney

Want to start your own newsletter?

I use Beehiiv and highly recommend it.

The content of this newsletter is for informational purposes only and does not constitute professional advice. I may have consulting agreements with, or financial interests in, companies mentioned in this newsletter. Additionally, some of the links included in this newsletter are affiliate links, meaning I may earn a commission if you make a purchase through these links. Always perform your own due diligence before making any financial or business decisions. *Affiliate link.